In Part 1, we defined the Second Banker’s problem and gave a formula for the optimal time to make a purchase. All of the proofs are given in this PDF.

Interest Income immediately before the optimal purchase time for the Second Panker’s problem

As with the first banker’s problem, the income from interest just before the optimal purchase time is

$$

\mathrm{interest\ income\ during\ purchase} = \frac{c \;r_1 r_2 }{r_2-r_1}.

$$

Notice that this income does not depend on the initial amount in the bank account $B_0$.

For example, if

- you initially have \$1000 in the account,

- the cost of increasing the interest rate is \$1,100,

- $r_1=0.05=5\%$, and

- $r_2=0.08=8\%$,

then $$\begin{aligned}\mathrm{interest\ income\ during\ purchase} &= \frac{c \;r_1 r_2 }{r_2-r_1}\\&= \frac{ \$1100\cdot 0.05 \cdot 0.08}{0.08-0.05}\\&= \frac{ \$55 \cdot 0.08}{0.03} \approx \$146.67\mathrm{\ per\ year.}\end{aligned}$$

REMARK

Note that the interest income can also be expressed by

\begin{equation}

\label{eqone}

\mathrm{interest\ income\ during\ purchase} = c/t_{\mathrm{pay}}

\end{equation}

where

\begin{equation}

\label{eqtwo}

t_\mathrm{pay} = \frac1{r_1} – \frac1{r_2}= \frac{c}{B_0 r_1 \exp(r_1 t_\mathrm{buy})}

\end{equation}

is the amount of time it takes to pay $c$ dollars from interest starting at the optimal time $t_\mathrm{buy}$.

For the previous example, we get

$$

t_\mathrm{pay} = \frac1{r_1} – \frac1{r_2} = \frac1{0.05} – \frac1{0.08} = 20 – 12.5 = 7.5\mathrm{\ years,\ and}

$$

$$

\mathrm{interest\ income\ during\ purchase} = c/t_{\mathrm{pay}}= 1100/7.5 \approx \$146.67/\mathrm{year}.

$$

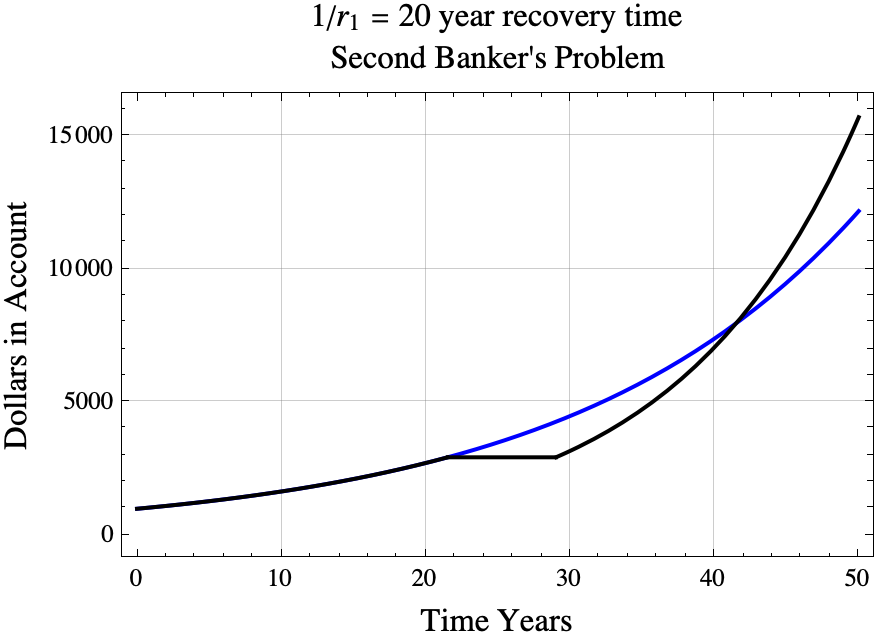

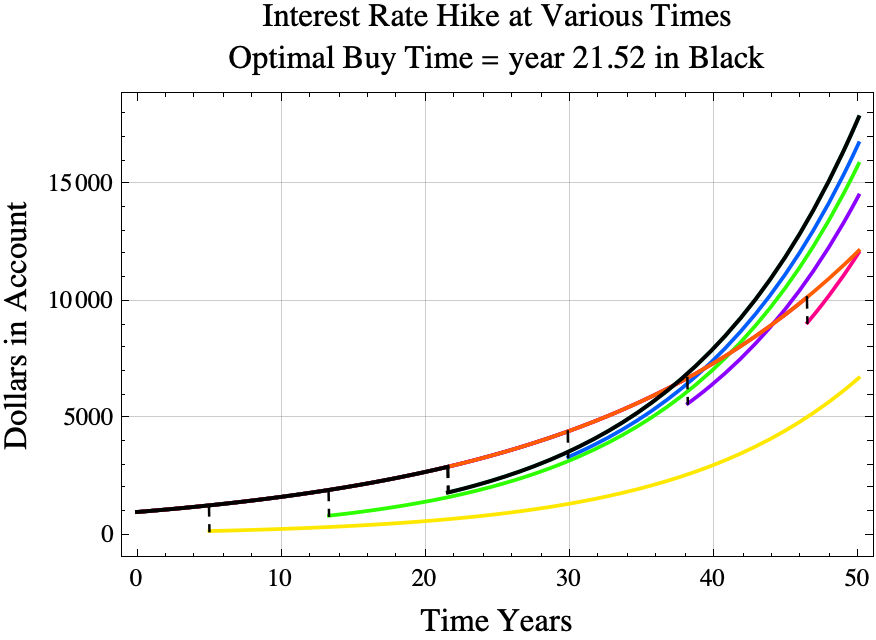

Recovery Time

If you do purchase the interest rate hike at the optimal time, how many years will you need to wait until the optimal strategy surpasses the never buy strategy. The recovery time for the second banker’s problem is almost, but not quite the same as the first banker’s problem. For the second banker’s problem,

$$

t_{\mathrm{surpass}} = t_{buy} + 1/r_1.

$$

For the example,

$$

t_{\mathrm{surpass}} \approx 21.5228+ \frac{1}{0.05} = 41.5228.

$$

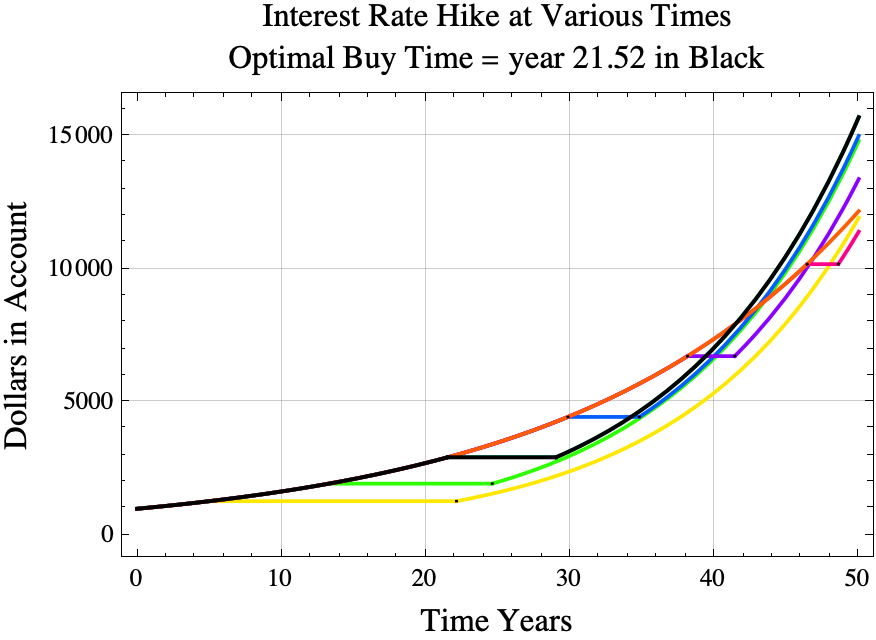

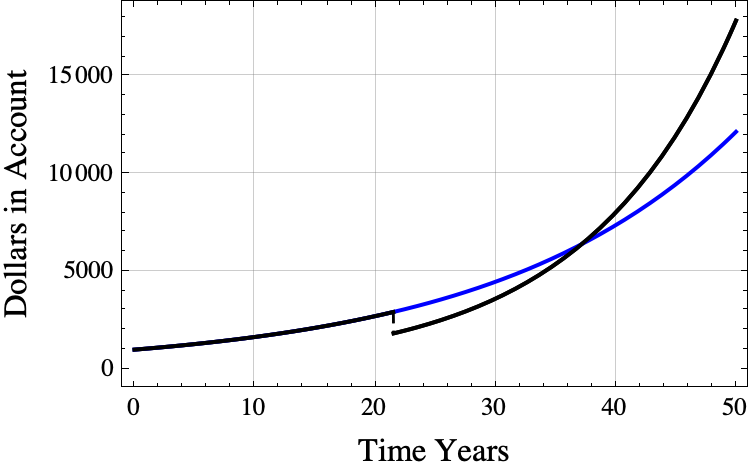

The black line shows the results of buying the interest rate increase at the optimal time. The blue line shows what happens if you never buy the interest rate hike and just continue to get 5% interest.

If you buy the interest rate hike at the optimal time, then you will maximize the account balance at all times $t>1/r_1$ years later. (Mathematically, for every $t> t_{\mathrm{buy}} + 1/r_1$, the strategy of purchasing the interest rate upgrade at time $t_{\mathrm{buy}}$ results in an account balance at time $t$ that exceeds the account balance at time $t$ using any other strategy.)